Affordable Housing Meets Smart Investing

Working families are being priced out of stable homes every day. Inside the Affordable Housing Collective, we’re connecting investors who want to build wealth by solving one of America’s biggest challenges.

Why This Strategy Works

Millions of families qualify for government-backed housing programs, but not enough landlords participate. That creates a demand-supply gap that investors can solve — and benefit from.

Government-Backed Reliability

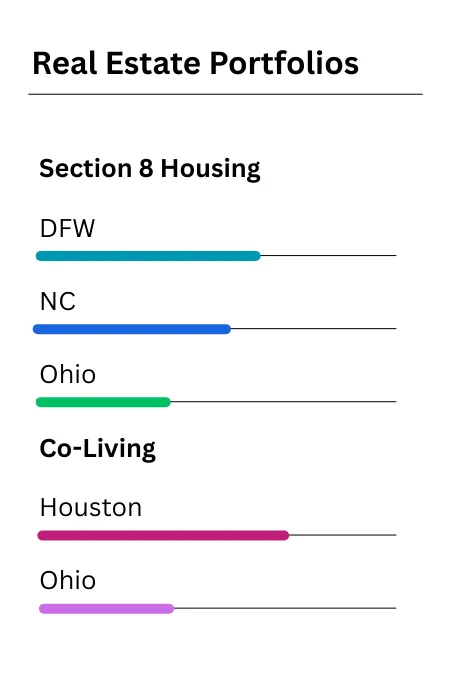

Section 8 is our core strategy because rent is paid directly by housing authorities, providing stability no matter the economy. Families stay longer, properties stay occupied, and income is consistent.

More Than One Path to Returns

Alongside Section 8, we explore co-living conversions and workforce housing repositioning. These strategies diversify portfolios, maximize cash flow, and meet the real needs of today’s housing market.

Why Now, Why Affordable Housing

The housing crisis is accelerating, and investors who move first secure the best opportunities. By joining the Affordable Housing Collective, you’ll learn how mission-driven strategies can build wealth while making a measurable impact.

Why Investors Join Us

Your Gateway to Smarter, Impact-Driven Investing

Learn what’s working now in affordable housing and why early movers gain the advantage.

Clarity on Affordable Housing Strategies

We break down how Section 8, co-living conversions, and workforce housing work in today’s market. You’ll see the mechanics behind government-backed programs and how investors are building resilient portfolios with them.

Access to Deal Insights

Our community discussions go beyond theory. We share transparent deal breakdowns, risk management approaches, and the realities of operating in affordable housing — the good, the bad, and the lessons learned.

A Mission-Aligned Network

This isn’t about chasing hype. It’s about connecting with investors who want returns that last — financially and socially. Inside, you’ll meet people who understand that the best investments solve real problems.

Behind-the-Scenes Learning

From due diligence to property management to tenant relations, you’ll see the process as it happens. You won’t just learn what works; you’ll learn how to avoid what doesn’t.

The Early-Mover Advantage

Most investors overlook affordable housing because of outdated perceptions. That creates a window of opportunity. By being here early, you position yourself ahead of the curve.

Ready to Take the Next Step?

Join Our Next Live Call

The best way to understand our strategy and community is to see it in action.

On this call, you’ll:

Learn how affordable housing strategies like Section 8 create government-backed stability.

See how Fractional makes investing accessible, transparent, and compliant.

Get your questions answered directly.

Seats are limited — reserve yours now to secure access.

Backed by Experience, Driven by Mission

We’re not theorizing about affordable housing — we’ve lived it.

For over 20 years, our family has managed Section 8 properties, building stable portfolios even during downturns. While other investors faced foreclosures in 2008 and rent strikes during COVID, government-backed rent checks continued to arrive.

Today, we combine that foundation with modern investing strategies — from portfolio acquisitions to co-living conversions — and a mission to provide dignified, stable housing for families who need it most.

Inside the Affordable Housing Collective, you’re not just learning concepts. You’re connecting with a team and a community who have walked this path and are ready to share what works, what doesn’t, and how to build wealth by solving real problems.

Join us inside Fractional and see how impact and returns align.

What is Fractional?

Fractional is the secure platform where the Affordable Housing Collective community lives and where our projects are shared. We chose it because it was built specifically for investors — making it possible to participate in real estate deals without needing to be an accredited investor.

There’s no cost to join Fractional, and joining doesn’t mean you’re committing capital. Inside, you’ll be able to:

Learn and Explore: Access education and analysis of affordable housing projects.

Review Real Opportunities: See projects with lower minimums than traditional syndications, structured for accessibility.

Invest With Confidence: If a project fits your goals, you can choose to participate. Fractional manages the compliance, legal setup, and distributions so everything is handled professionally.

Fractional isn’t new — operators have already raised over $400 million using the platform. It’s a proven, compliant, and secure way for communities like ours to collaborate around real estate.

👉 Joining the Affordable Housing Collective on Fractional is free. It gives you a transparent way to learn, connect, and decide if affordable housing investing is right for you.

Still Have Questions? We’ve Got You Covered

We know investing decisions aren’t made lightly. Here are answers to the most common questions investors ask before joining our community.

Do I have to pay to join Fractional?

No. Joining the Affordable Housing Collective on Fractional is completely free. You can access the community, education, and project information without paying for the platform.

Do I have to invest right away?

Not at all. You can join simply to learn and connect. If you see a project that fits your goals, you can choose to participate. If not, you can stay for the education and discussions.

Who can invest — do I need to be an accredited investor?

Fractional is designed so both accredited and non-accredited investors can participate. This makes affordable housing projects accessible to a much wider group of investors.

What’s the minimum investment if I decide to participate?

Minimums vary by project, but are often lower than traditional syndications. For example, projects may start around $20,000 (even $10,000), compared to $50K–$100K+ in many other structures.

Is this safe and compliant?

Yes. Fractional handles all compliance, legal structures, and investor protections. That includes LLC formation, operating agreements, and distributions. Funds are processed through regulated banking partners, and investors receive clear reporting.

How do I get updates on a project I invest in?

Inside Fractional you’ll have access to updates, financial reports, and voting tools. You’ll be able to see progress, ask questions, and participate in key decisions.

What if I just want to learn without investing?

You’re welcome here. The Affordable Housing Collective is about education and community as much as investment. You can join calls, access resources, and learn about affordable housing strategies with no obligation to commit capital.

Learn how a new wave of investors is turning affordable housing into a community-driven strategy for both impact and long-term resilience.

Disclaimer:

The Affordable Housing Collective is an educational and community platform hosted on Fractional. Participation in the community or registration for live sessions does not constitute an offer to sell or a solicitation of an offer to buy any security. Any investment opportunity discussed will include separate offering documents for review. All investments involve risk, including the possible loss of principal. Past performance is not indicative of future results. Please consult your financial and legal advisors before making any investment decisions.